Feature

Tax reform on the horizon

Issue 5

December 18, 2023

By Miranda L. Simpson, CPA

More than nineteen years ago, I took my first college course in taxation and learned several tax concepts; one classmate asked the professor about tax simplification, and the professors answer stands out in my memory. Each presidential election cycle brings debates about simplifying taxes; the professors answer was he raises his billing rates when Congress mentions simplifying the tax code.

In all my years practicing as a tax professional since, what he said rings true more each year; the changes and intricacies of the tax code are never ending. When we fully understand a concept and plan for our clients accordingly, something changes.

Tax simplification would make life easier for some, but history paints an unlikely outlook for this sentiment. Temporary tax law changes passed at the end of 2017 as part of the Tax Cuts and Jobs Act (TCJA) are no exception. Several temporary tax laws will expire on December 31, 2025, including all the individual changes and the estate tax exemption. But with an election year next year in 2024, their fate is anyone’s guess. We cannot predict what will happen with certainty, but a few bills out in the legislature that may provide hints about what Congress is focusing on in the near term.

Tax Cuts for Working Families Act

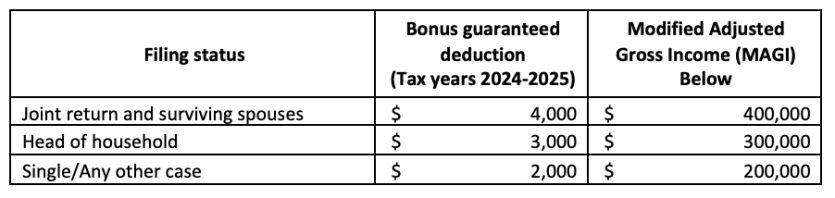

H.R. Bill 3936, described as the “Tax Cuts for Working Families Act,” attempts to replace the long-standing concept of the standard deduction with a new term coined the “guaranteed deduction.” This new and slight change to the wording brings with it a bonus deduction for tax years 2024 and 2025. For these two tax years only, taxpayers whose income is less than a certain threshold may be eligible to deduct up to an additional $4,000 above the typical standard, or rather, guaranteed deduction. Below is a schedule of the proposed bonus deduction for each filing status.

Federal Tax Update with Ron Roberson

January 17-18, 2024, Attend virtually or in-person at the Gratzer Education Center, Louisville16 CPE hours/13.25 CLE credits

Early Bird Fees (Register by Jan. 3, 2024): KyCPA member fee: $529, Nonmember fee: $729

Small Business Jobs Act

The next Bill, H.R. 3937, the “Small Business Jobs Act” is chalked full of a bit more substantial changes and fewer play on words. The following are summaries of some of the proposed changes included in this bill that are intended to target small businesses:

- Increase the current Form 1099 non-employee compensation reporting requirement from $600 to $5,000 and adjust for inflation every year thereafter (which has not happened in nearly 70 years apparently).

- Repeal of a change made as part of The American Rescue Plan Act of 2021 (P.L. 117-2), which significantly reduced Form 1099-K reporting requirements. Prior to P.L. 117-2, Form 1099-K was required to be filed for online sales of goods and services that exceed $20,000 in annual sales and 200 transactions. P.L. 117-2 reduced the annual sales threshold to $600 and eliminated the transaction requirement. If H.R. 3937 is passed, then this requirement reverts to the previous rules.

- Modifications to Internal Revenue Code (IRC) Section 1202, exclusion of gain from qualified small business stock: Currently, to qualify for this attractive 100 percent exclusion of tax on a stock sale, in general, one must hold stock in a small business C-Corporation for five years or more prior to the sale. The proposal expands the rules in three distinct ways:

- Provides a 50 percent tax exclusion if the stock is held for at least three years; 75 percent tax exclusion if held for at least four years.

- Stock held in S-Corporation would also qualify for the exclusion.

- Allows investors to add their qualified convertible debt holding period to the holding period requirement.

- Increase IRC Section 179 from the current limitation of $1 million ($1,160,000 in 2023) to $2.5 million beginning after December 31, 2023. The limitation is reduced by the total cost of property placed in service that exceeds $2.5 million ($2,890,000 in 2023) to $4 million beginning after December 31, 2023. Both the limitation and total property threshold will be adjusted for inflation each year beginning after 2024.

- Establish Rural Opportunity Zones: Similar to the opportunity zones created within TCJA (P.L. 115-97), this provision allows for temporary deferral of inclusion in gross income for capital gains reinvested in a qualified rural opportunity fund and the permanent exclusion of capital gains from the sale or exchange of an investment in the qualified rural opportunity fund. The designation of a rural opportunity zone is determined by Census Bureau reporting and methodologies for “persistent poverty community populations.”

Build It In America Act

As the name of the bill suggests, H.R. 3938, “Build it in America” focuses its provisions on issues that may encourage companies to invest in America, instead of overseas. Lawmakers are making the following proposals included in Title I of the Bill– “Investment in America”:

- Immediate deduction for research and experimental expenditures beginning after December 31, 2021, and before January 1, 2026. Currently, these expenditures are required to be deducted over a five-year period, or 15-year period if research is conducted outside the United States.

- Extension of EBITDA (earnings before interest, taxes, depreciation, and amortization) for purposes of calculating the limitation of the business interest expense deduction. This provision would be effective beginning after December 31, 2022, and, if elected, for tax years beginning after December 31, 2021. Current tax law imposes the limitation without regard to EBITDA.

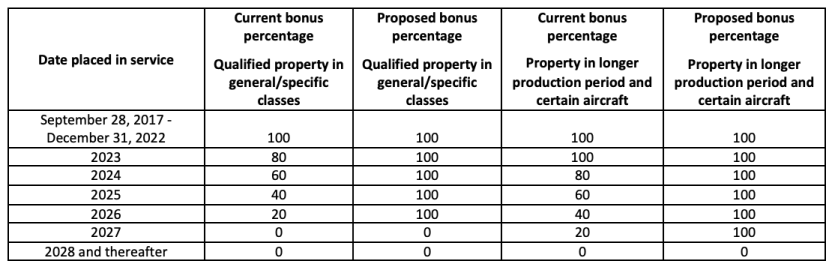

- Extension of 100 percent bonus depreciation for qualified property placed in service after December 31, 2022, and before January 1, 2026 (after December 31, 2023, and before January 1, 2027, for longer production period property and certain aircraft). Without this change, beginning after December 31, 2022, bonus depreciation is scheduled to be reduced by 20 percent each year. See schedule below for the phase out of this deduction alongside the proposed changes:

Title III of the Bill – “Repeal of Special Interest Tax Provisions” sets out to eliminate certain tax subsidies for clean energy and electric vehicles included in the Inflation Reduction Act. Such repeals and modifications include:

- Repeal of clean electricity production and clean electricity investment credits

- Modification of clean vehicle credit: The credit is returned to the new qualified plug-in electric drive motor vehicle credit. The base credit is $2,500 increasing up to $7,500 depending on KWhr battery capacity, a 200,000 vehicle per manufacturer limitation, and a manufacturer’s suggested retail price (MSRP) of $55,000 or less for cars and $80,000 or less for vans, SUVs, and pickup trucks. Taxpayers who want to take advantage of these credits must fall below adjusted gross income (AGI) limits of $300,000 for married filers and $150,000 for all other taxpayers.

- Repeal of credit for previously owned clean vehicles and the credit for qualified commercial clean vehicles: A transition rule is provided for taxpayers who already entered a binding contract within a year of either of these original credit introduction dates.

Please note that this is not an in-depth analysis of these three bills but rather highlights of the information contained in each. As with many tax proposals, the final bills could look completely different or not get pushed through at all. But as I mentioned in the beginning, 2024 is certain to bring forth discussions and debates about the future of tax reform.

About the author: Miranda L. Simpson, CPA, can be reached at mirandaleighsimpson@gmail.com. Simpson is a self-employed CPA with extensive experience in tax. She has authored many federal tax articles for The Kentucky CPA Journal.