Legislative

2023 Legislative session preview

Issue 4

December 20, 2022

By P. Anthony Allen

The upcoming 2023 Legislative Session will begin on Tuesday, January 3, 2023, kicking off the 30-day “short” Session that is scheduled to end on March 30, 2023. Kentucky legislators will convene in the first week of January, take a break, and then reconvene at the beginning of February to finish the Session.

CPA Day at the Capitol

Please join us on February 8 in Frankfort for this important event! A great way for your voice to be heard. Find out more and register below. (FREE for KyCPA members.)

With Republicans strengthening their supermajorities in both the Kentucky House of Representatives and Senate following the 2022 midterm elections, the current political landscape will make for another interesting Session as the General Assembly possesses the power to override any veto Governor Andy Beshear may deliver. Thus, we will likely continue to see a conservative tilt in legislative policy in 2023. Leaders of both political parties and Chambers will also address the steep learning curve of introducing 25 new Members of the House and 6 new Senators to the legislative process and procedures. Due to new Committee Chairs and assignments, change in caucus leadership, and new legislators, this upcoming Session will be organizational in nature.

Due to support through your membership, contributions to the KyCPA Political Action Committee, and involvement with our policy initiatives, the Society and our advocacy team have prepared to advocate for sound tax, audit, and professional regulatory policies. For the final issue of the 2022 KyCPA Journal, below is a preview of some of the key issues we will be closely monitoring and prioritizing for the 2023 Legislative Session.

Tax reform modifications

Following multiple tax reform measures, unemployment insurance modifications, and the 2023-2024 biennial budget, the Session is projected to be less momentous than the last when it comes to major policy implications. With 30 official days, the General Assembly will attempt to focus on specific measures that follow up on the legislative policy initiatives that took place during 2022. As the Beshear Administration, and specifically the Kentucky Department of Revenue, works through the issuance of regulatory guidance in preparation for the 2023 tax season, the General Assembly will most likely provide updates to clarify legislative intent regarding specific tax laws. This will be a primary issue the Society will continue to track and engage with directly during the next Session.

A major provision of follow-up for the General Assembly this next Session will be an affirmation vote of the continued decrease of the individual income tax rate from 4.5 percent to 4 percent. With the passage of House Bill 8 in the spring, Kentucky’s individual income tax rate decreased from 5 percent to 4.5 percent because revenues exceeded the specific requirements outlined by the legislation. As a reminder, reduction conditions are specified as the balance in Kentucky’s Budget Reserve Trust Fund (Rainy Day Fund) at the end of a fiscal year must be greater than or equal to 10 percent of General Funds for that fiscal year. In addition, the General Fund at the end of a fiscal year must also be greater than or equal to General Fund appropriations plus the amount of reduction in the General Fund from a one percent reduction to the individual income tax rate. The initial reduction was automatic however, future reductions will require revenues to meet these specific conditions in addition to an affirmative vote by both Chambers of the General Assembly. Following the fiscal year 2022 total state receipts, the individual income tax rate met the reduction rate conditions and the General Assembly plans to lower the individual income tax rate to 4 percent.

KyCPA policy priorities

In addition to the decrease of Kentucky’s individual income tax rate, it is likely only technical tax priorities will have a chance of passage this upcoming Session. Multiple members of leadership in both Chambers of the General Assembly have publicly stated that budgetary and revenue implications will be either non-existent or exceptionally specific in 2023. At the Kentucky Chamber of Commerce’s Legislative Preview Conference in November 2022, Senate Floor Leader Damon Thayer stated to business leaders, “Lower your expectations, I hope that we don’t open the state budget, don’t open the road plan, and really make the main focus tweaks and improvements to existing laws.”

Each year, KyCPA recommends legislators follow the guiding principles of sound tax policy. These include the issuance of clear administrative guidance, certainty, predictability, avoiding double taxation, and strongly opposing a sales tax on professional services. These principles will be especially helpful for new legislators without a tax background to review and consider.

Building upon the guiding principles of sound tax policy, KyCPA supports the implementation of further tax simplification throughout the Commonwealth. This includes an update to Kentucky’s Internal Revenue Code conformity, referring to the degree to which a state tax code conforms to the federal tax code and simplifies a state’s implementation of its tax policy by using federal taxable income as a starting point for calculations. Simplification also includes the protection and enhancement of taxpayer rights. The implementation of a fair tax code plays a significant role in the Commonwealth’s economic development efforts. Not only do businesses want to locate, invest, and expand in states that have competitive tax rates, but perhaps equally important, they want reasonable assurances that our tax laws will be enforced transparently, efficiently, consistently, and equitably.

The Limited Liability Entity Tax (LLET) is a unique tax that KyCPA believes should be appealed. However, if the LLET is retained, KyCPA supports legislation to align Kentucky’s LLET COGS definition with that of the COGS definition for federal and Kentucky income tax purposes. When discussing simplification of Kentucky’s tax code, simplification should be a high priority to minimize the costs of the Department of Revenue and local governments and businesses, including costs associated with collecting taxes, examining returns, and resolving disputes. The current local tax system, where all 120 counties, hundreds of cities and numerous school districts have different rules and filing requirements, is increasingly burdensome as businesses become more mobile. KyCPA supports alternative standardization and consolidated collection mechanisms that will ease the bureaucratic burden on multi-jurisdictional and individual filers.

Another important issue the General Assembly reviews, oversees, and implements statutory guidance for is the professional licensing of CPAs and other trades. Licensing boards provide the systems for ongoing education for professionals and weakening licensing would diminish the ability of the licensing boards to establish, verify, and enforce necessary expertise. KyCPA strongly opposes any calls to eliminate or weaken professional licensing in Kentucky, which would create an unfavorable business climate in the Commonwealth.

With legislative intent clearly stated prior to the start of the Session, KyCPA will primarily focus on technical tax relief measures and updates to Kentucky’s tax code. An update to Kentucky’s conformity with the Internal Revenue Code is legislation that will enhance taxpayer compliance, limit the bureaucratic burden of remitting state and federal taxes, and remains a top priority for KyCPA each year as the federal code continues to evolve.

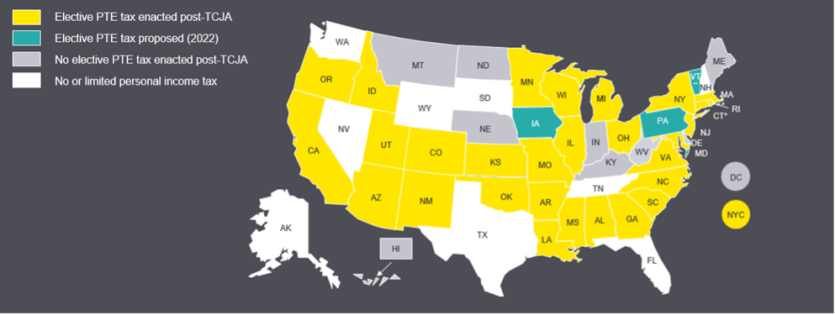

In addition, a specific tax simplification issue has arisen within the last few years that states can address via legislative action. A provision of the Tax Cuts and Jobs Act of 2017 sets a $10,000 cap on the amount of state and local taxes (SALT) paid that an individual can deduct when calculating their federal tax liability. This cap negatively impacts individuals, especially those organized as pass-through entities (PTEs) which include shareholders, partners, or members of S corporations, partnerships, and limited liability companies.

Examples of PTEs would include local restaurants, firms, auto dealerships, independent contractors, and other main street businesses. Parity means the state or condition of being equal. SALT Parity relief would provide an equal federal tax treatment of PTEs compared to the 30 other states that have adopted this policy, including Kentucky’s border states of Ohio, Illinois, Missouri, and Virginia. The policy would also provide equal federal tax treatment between PTEs and large corporations, which do not have a federal SALT deduction cap.

KyCPA supports legislative action that will allow PTEs to elect to pay SALT on their business income at the entity level. By permitting the SALT deduction at the entity level, the individual owner may avoid the $10,000 SALT cap and have a reduction in their federal individual income tax liability. The effect of an electable entity-level tax program is to allow the qualifying PTE to shift the income tax burden from the PTE owners to the PTE itself. For companies that make this election, the reform will:

- Impose an electable entity-level tax at the state’s individual income tax rate.

- Allow PTE business owners the benefit of tax credits and taxes paid in other states that have adopted or will adopt these reforms.

Importantly, taxes paid to the General Fund will not be impacted. The goal of this policy is to allow business owners the ability to pay their tax liabilities at the entity level and keep state revenues consistent. Savings achieved by this legislation will lower the federal tax liabilities of individual PTE owners. Thus, Kentucky PTE business owners will get a solution to the Federal SALT cap at no cost to the state.

SALT parity map 2023

Local government tax reform

During the 2022 Legislative Session, House Bills 475 and 476 narrowly missed the opportunity to add another Constitutional amendment issue to the 2022 election ballot. House Bill 475 proposed an amendment to Section 181 of the Kentucky Constitution that would provide authority to the General Assembly to authorize localities the ability to assess local taxes, provide a ballot question with the amendment, and propose this question before Kentucky voters for ratification during the 2022 November election. If the Constitutional amendment were to pass and be ratified by Kentucky voters, House Bill 476 would provide additional statutory guardrails by outlining the General Assembly’s authority over what specific local taxes could be implemented.

Although these two bills received strong support during the 2022 Session, they ultimately did not pass the Senate. Proponents of the issue are certainly gearing up for another advocacy campaign this upcoming Session however, if passed, the Constitutional amendment would not show up on the general ballot until November 2024. KyCPA remains neutral on this issue however, if passed, the Society strongly recommends simplified tax collection and guiding sound administrative procedures.

Other major policy initiatives to consider

Other policy issues under consideration in this upcoming Session include workforce development. Kentucky’s current labor participation rate is 57.7 percent, with approximately 100,000 more open jobs than unemployed individuals in the Commonwealth currently searching for work. Another issue related to workforce is access to and availability of early childhood education and childcare. Having affordable and quality options allows parents and guardians the ability to better participate in Kentucky’s labor force.

Similar to local government tax reform, a few issues were introduced last Session but did not gain enough support to obtain final passage. Sports wagering, the legalization of medical and/or recreational cannabis, and the regulation of the “skill-based/grey machines” gaming industry. Each of these issues will likely be elevated and addressed in this coming Session.

These are just a few of the major issues to be considered by the 2023 Kentucky General Assembly. Be sure to keep up to speed with the Session by reading our weekly legislative updates and following us on social media.

Questions or Comments

If you have any questions, comments, or feedback, please feel free to reach out to the Society’s Government Affairs Director, P. Anthony Allen, at aallen@kycpa.org.