Check out below the interview with Jan Taylor-Morris and Julia Woislaw from the American Institute of CPAs on KyCPA's Behind the Numbers. They discuss CPA Evolution and the future plans for the CPA Exam. Woislaw and Taylor-Morris are speaking at this years KyCPA Kentucky Accounting Educator's Conference on May 20-21, click here for details.

CPA Evolution is a joint initiative of the National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA). The initiative is transforming the CPA licensure model to reflect the rapidly changing skills and competencies the accounting profession requires today and will require in the future. It will put in place a flexible and adaptable licensure approach that will serve as the foundation for future-proofing the CPA profession.

Over three years, NASBA and the AICPA gathered input from more than 3,000 stakeholders from across the profession on how to transform CPA licensure and meet the needs of the marketplace. During these conversations, several key themes became clear:

- The profession supports the need to change the CPA licensure model

- Newly licensed CPAs should all demonstrate strong common core competencies

- The new CPA licensure model should position the CPA for the future

- The new CPA licensure model should continue to protect the public interest

Based on this feedback and lessons learned from studying other international and domestic licensure models, NASBA and the AICPA developed a new approach to CPA licensure. In 2020, both the AICPA Governing Council and the NASBA Board of Directors voted to support advancement of the CPA Evolution initiative. The AICPA and NASBA are now moving forward with implementing the new model.

What is the new licensure model?

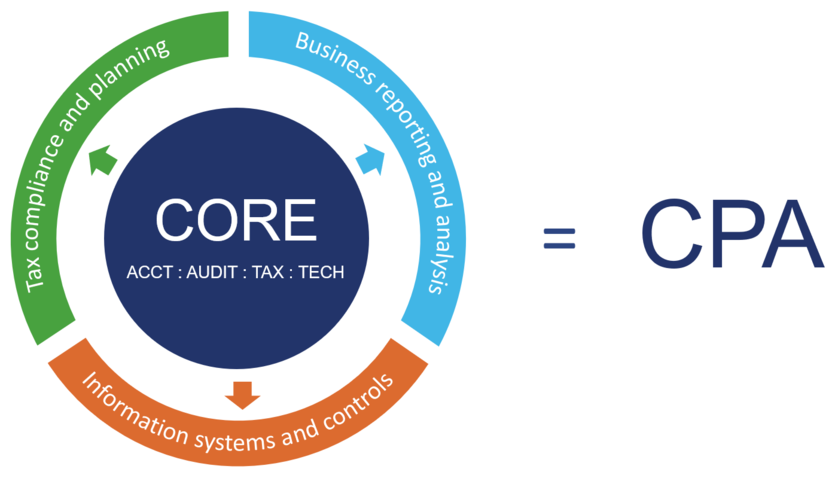

The new CPA licensure model takes a core + discipline approach, starting with a deep and strong core in accounting, auditing, tax and technology that all candidates will be required to complete. Each candidate will also choose a discipline in which to demonstrate deeper skills and knowledge. Regardless of chosen discipline, this model leads to full CPA licensure, with rights and privileges consistent with any other CPA. A discipline selected for testing will not mean the CPA is limited to that practice area.

This model:

- Enhances public protection by producing candidates who have the deep knowledge necessary to perform high-quality work, meeting the needs of organizations, firms and the public.

- Is responsive to feedback, as it builds accounting, auditing, tax and technology knowledge requirements into a robust common core.

- Reflects the realities of practice, requiring deeper proven knowledge in one of three disciplines that are pillars of the profession.

- Is adaptive and flexible, helping to future-proof the CPA as the profession continues to evolve.

- Results in one CPA license.

What does this mean for the Uniform CPA Examination?

The specific content of the core and the disciplines will be determined by a CPA Exam practice analysis, which is currently underway.

Practice analyses — gathering information about the current and future state of the profession and the work of newly licensed CPAs — are conducted periodically as part of the AICPA’s ongoing efforts to make sure the Exam is current and to maintain its the validity and reliability. The current practice analysis will likely wrap up in 2022, and an Exam Blueprint will be exposed for public comment in mid-2022.

The AICPA and NASBA expect the new Exam will launch in January 2024.

What’s next for students and CPA candidates?

Aspiring CPAs who are college freshmen now will be among the first to take the overhauled version of the CPA Exam when it launches in 2024. Current CPA candidates will be able to sit for the current CPA Exam until the launch of the new Exam, and a transition plan is being developed for candidates who have started but not completed the CPA Exam process as of January 2024. Under the new model, the AICPA and NASBA expect to attract students that today wouldn’t necessarily choose the CPA route, but who are becoming more critical to the success of the CPA profession.

How are the AICPA and NASBA supporting accounting academic programs and educators?

Accounting educators will play a vital role in preparing students to pursue the CPA under this new licensure model. The AICPA and NASBA are committed to helping educators every step of the way.

The AICPA and NASBA have engaged with faculty and practitioner volunteers to build a model curriculum that aligns with the core + discipline licensure model. The model curriculum will launch this June, and updates will be posted on EvolutionofCPA.org.

Faculty can also access the Academic Resource Hub, a free database of content from the AICPA, accounting firms, academics and AICPA teaching-award winners that will help faculty prepare students for the rapidly evolving demands of the profession. The hub contains over 200 resources for a range of class levels on topics like data analytics and cybersecurity to use in classroom instruction.

Throughout 2021, the AICPA will be holding a series of faculty webinars including regular updates on CPA Evolution and deep dives into emerging topics to include in accounting courses.

As CPA Evolution continues to progress, please check back for updates at EvolutionofCPA.org. If you have any questions, please reach out to Feedback@EvolutionofCPA.org.